All Change

With a new PM, a new King and a currency in freefall, it’s time again for seismic change. But in London’s property market, such uncertainty is good news for some.

If ever there were a moment that epitomised the unnerving sense of flux we feel right now, it’s the 48 hours in September that saw the arrival of a new Prime Minister closely followed by the sad passing of our treasured Queen Elizabeth II.

Just a few months ago, one of the most immortalised scenes during the Platinum Jubilee and most fondly remembered is the magnificent moment when, over tea with Paddington Bear, Her Majesty’s eyes twinkled as she extracted a marmalade sandwich from her handbag. A final image that we will forever associate with the end of the reign of the country’s longest-ever serving monarch.

Within a fortnight, however, even those memories had been eclipsed by the shock tax cuts announced by the new Chancellor, Kwasi Kwarteng, which instantly lead to the pound plunging to near parity with the dollar and euro.

It’s a time of momentous change. For many would-be buyers and sellers in the London housing market, it feels like the latest in a long line of reasons to clamber right back onto the fence, which they have found to be a secure, if not particularly comfortable, perch over the last few years. Stamp duty rises and falls, Brexit, global pandemic, the war in Ukraine, economic shocks… how we all wish for things to be, and feel, reassuringly uneventful again.

“Impending financial recession and severe inflation are making people say ‘hang on, let’s see what’s happening’,” comments Marlon Lloyd Malcolm, Sales Director at Lurot Brand. This summer, he adds, was the quietest he can remember, “for enquiries, viewings, offers, everything.” Part of the reason, he suspects, is the desire among Londoners to escape abroad after two years of holidaying at home, and they were leaving the phone at home – the old attitude of calling from the beach has gone out of the window.

Agents’ inboxes started to fill up again after the summer lull. Once schools re-open their gates, many parents step up a gear, acting on new ambitions and resolutions that make early September, rather than January 1st, feel like the real start of a new year. “Even though families aren’t our demographic, we deal with people who are still influenced by the start of the school year – often because they have children whose own kids have gone back to school,” says Lloyd Malcolm. “Their attitude to booking property viewings has changed; they are no longer booking for next week. Now they are calling to say they are in London this morning and requesting to view a certain property at 12. There’s a sense of urgency.”

For some, flux is a wonderful thing. Hello, all you Americans out there, who are now getting the best exchange rate ever. Prime London estate agents are reporting US buyers pitching up with big budgets – tens of millions, in some cases – to spend, purely because of the exchange rate. “The currency shift means that dollar buyers no longer have to factor in the stamp duty as that extra cost has been absorbed by the currency rate swinging so dramatically in their favour,” says Lloyd Malcolm of the deterrent that has stood in the way of buyers since the first SDLT changes in 2014.

All of a sudden, he finds himself regularly explaining the nuances of ‘freehold’ and ‘leasehold’ to the American buyers who stroll into his office, looking to diversify their property portfolios this side of the pond. For while London’s history, cultural heritage and liberal environment – politically, and lifestyle-wise – chime with many American buyers, the complexities and limitations of leasehold property makes little sense to those from anywhere other than New York, says Lloyd Malcolm. And for all buyers, wherever they are from, this era of rocketing living costs and energy prices makes freehold property a more reassuring proposition than ever. “With a freehold house, you don’t have the worry of outgoings rising out of your control. You can control the bills and improve your property’s insulation and energy performance,” he says.

The new stamp duty cuts that came into force on September 23rd – increasing the threshold at which first time buyers pay SDLT from £300,000 to £425,000 (and from £125,000 to £250,000 for all other buyers) – may provide a further incentive to invest in London property. But, while at the high end of the market, this SDLT saving is “nice to have,” says Lloyd Malcolm, “it doesn’t touch the sides. It amounts to a saving of around £2,500 for buyers in the upper brackets, and the ramifications of this stamp duty cut – the devaluation of the pound, the predicted inflation rises – won’t be to anyone’s benefit.”

Many buyers don’t need stamp duty cuts in any case to persuade them to invest here. These may feel like chaotic times to us, but it’s all relative. To buyers from elsewhere

in the world, London is still a beacon of stability. “We’re seeing sophisticated investors who have made their money out of the investment markets now terrified of keeping their money in them,” says Lloyd Malcolm. “With bricks and mortar, they know what they are getting and while it may have its ups and downs, the constant need for an asset that is also a shelter is reassuring.”

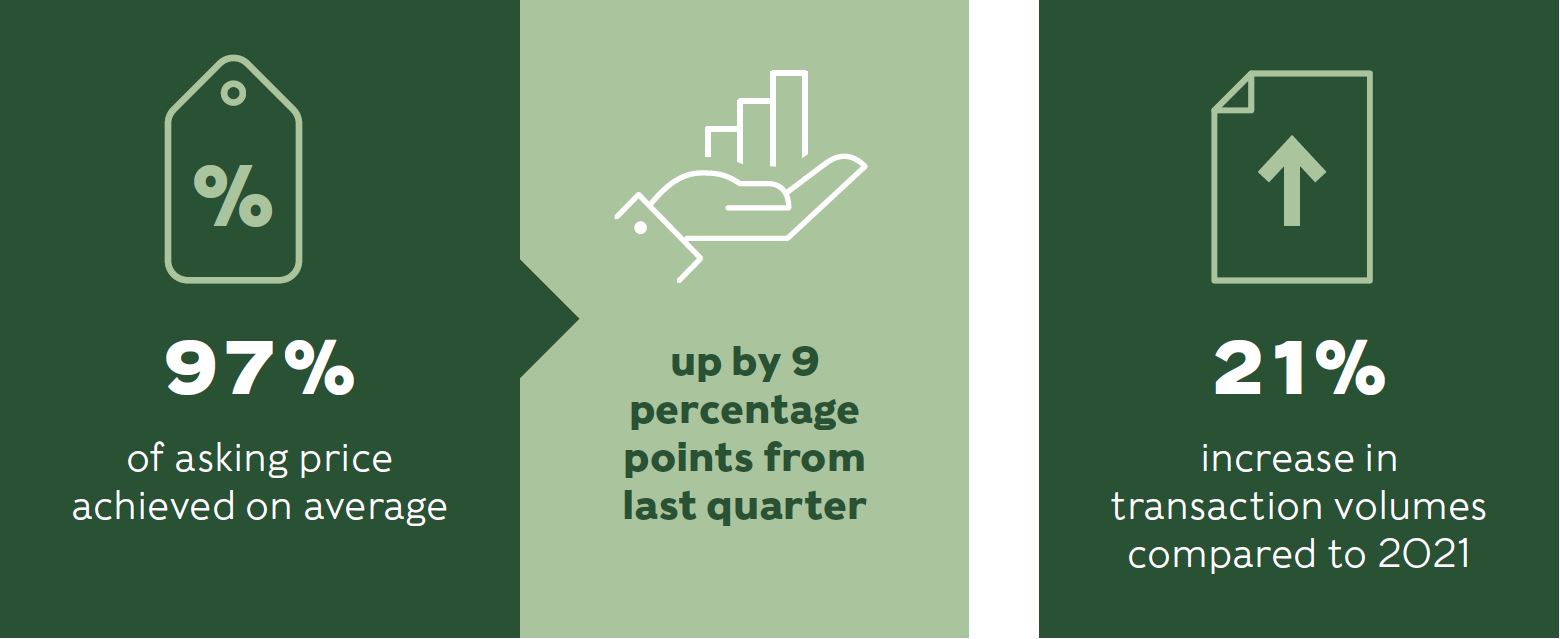

STATISTICS FOR MEWS SOLD BY LUROT BRAND IN THE LAST 9 MONTHS

Inflationary times have also historically been good for London’s property market, with property considered a good hedge against inflation, and effectively a bonus for anyone with a long-term, fixed rate mortgage. “For argument’s sake, if the interest rate is 3% and inflation is 10%, you have a net gain of 7% on fixed rate debt raised,” Lloyd Malcolm points out. Long-term, however, isn’t just a concept foremost in the minds of mortgagees. It’s the only way to view a central London property purchase, given the huge stamp duty sums involved. “A property purchase right now isn’t to gain, it’s to remain,” says Lloyd Malcolm. “There has to be a notion of needing it for the next 10 or 20 years. People aren’t in it for massive profit; they want to protect what they have.”

In the prime London market, the mismatch in demand and supply has fuelled a sense of urgency – and, in some cases, frenzy – in the last couple of years, with bidding wars having become the norm in some sectors for a while. But Lloyd Malcolm says he expects to see a rise in stock levels in coming months, which will provide muchneeded “breathing space” for buyers.

The mews market, in particular, is made up of many second homes – and when owners start to feel the squeeze, the second home is the first thing to go. Others, says Lloyd Malcolm, are realising they aren’t in London as much as they used to be and don’t need such a big space, so they are selling up to downsize.

“People want liquid cash in times of stress,” says Lloyd Malcolm. “There is demand for central London property, but supply is coming back too, and that should result in a more liquid market.”

BY ZOE DARE HALL Property Freelance Journalist of the Year 2021, International Property Journalist of the Year 2021, Lifestyle & Interiors Journalist of the Year 2021 (Property Press Awards)

Accurate, evidenced, free valuations with no obligation from the specialists in mews.